Coinme’s partnership with MoneyGram opens a new gateway for everyone to be able to participate in the digital currency economy.

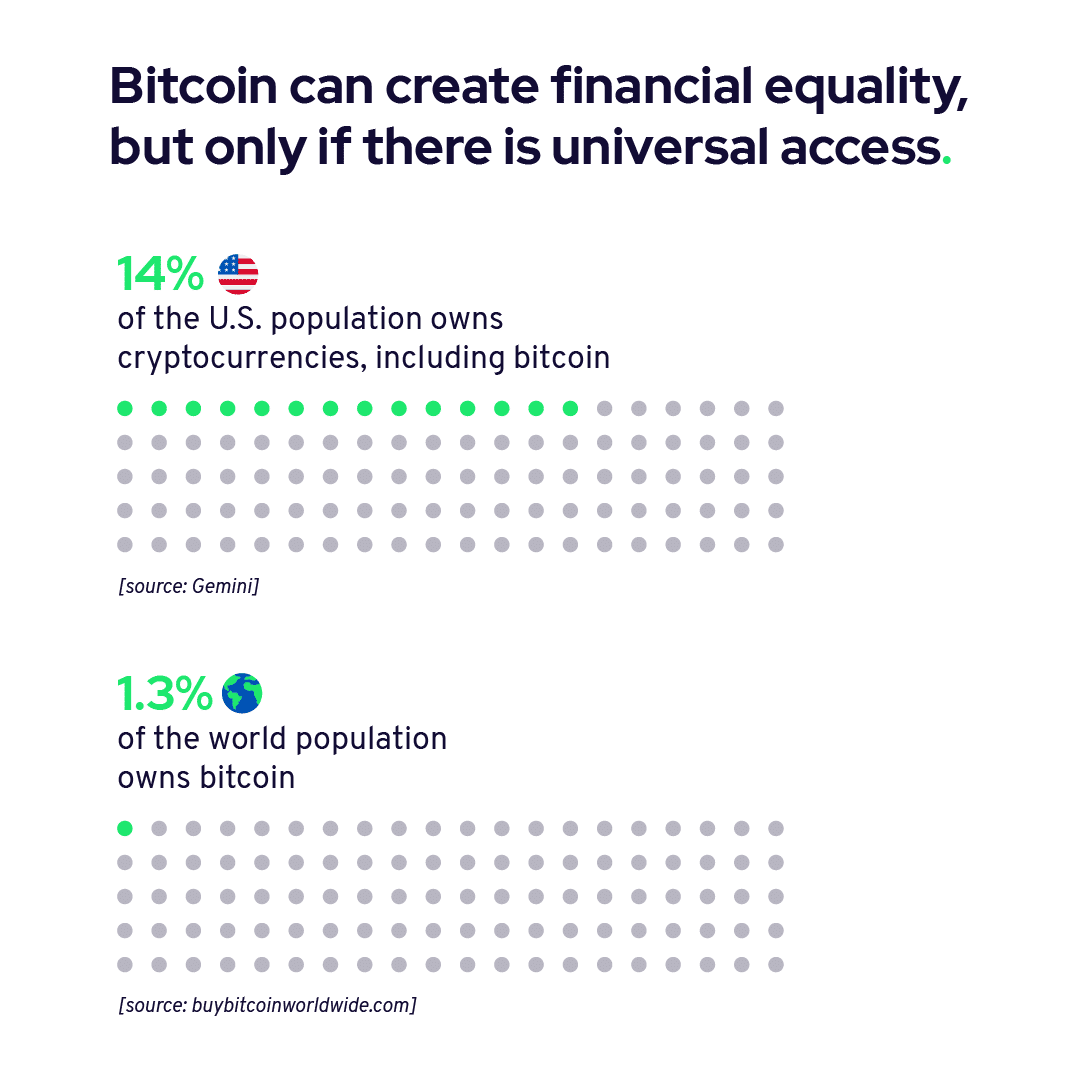

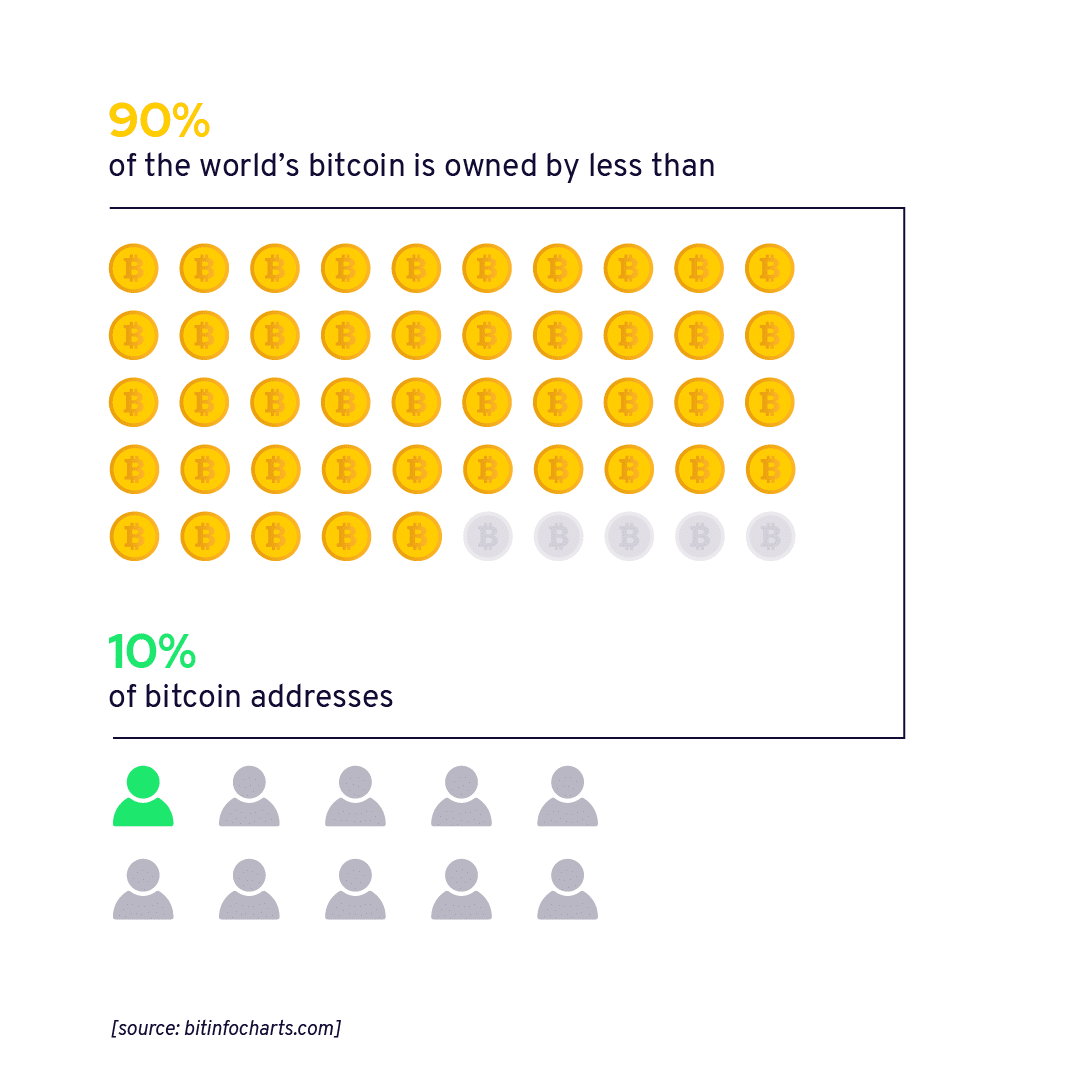

Lopsided adoption

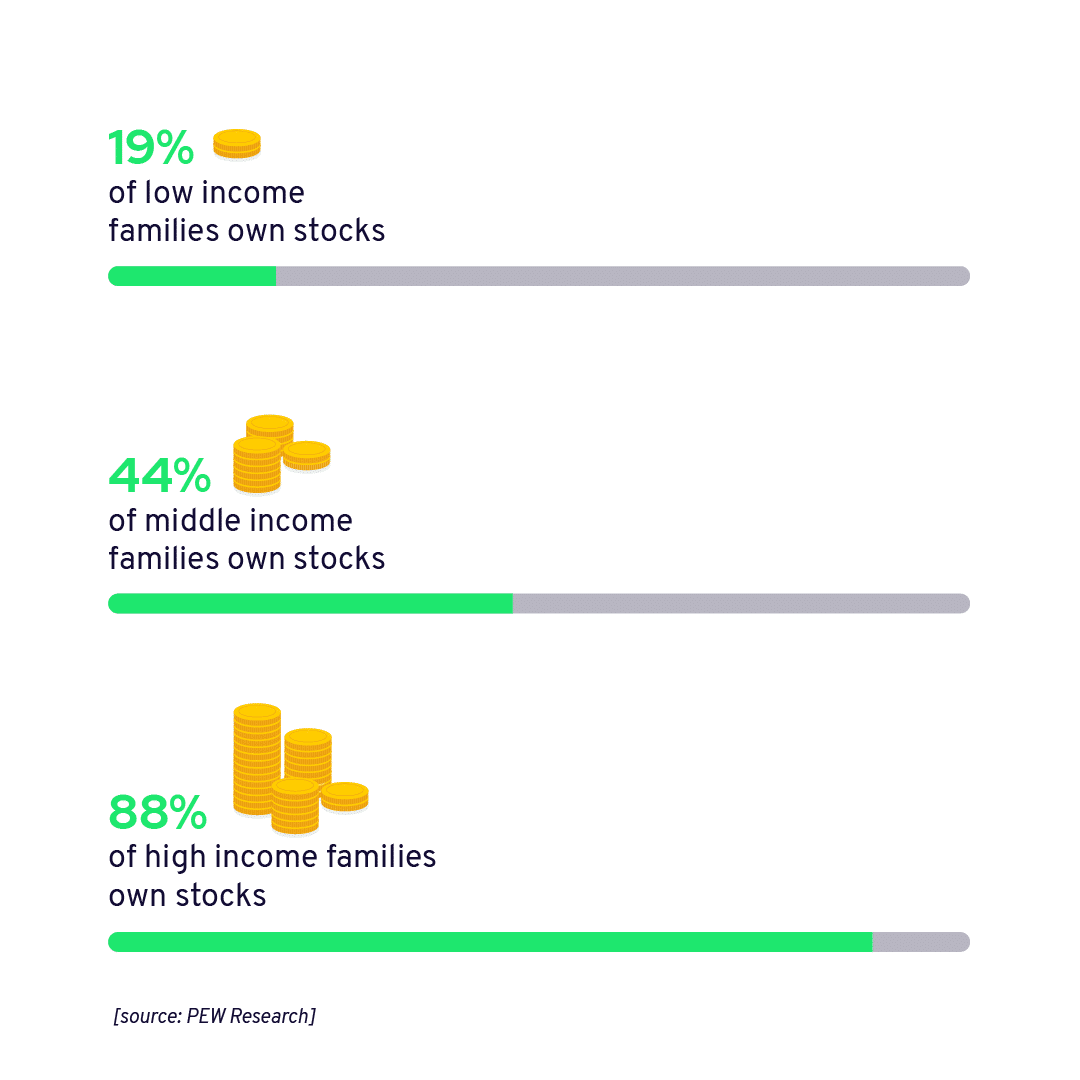

Bitcoin’s early adopters are starting to amass bitcoin fortunes. Unless there is more access for everyday consumers, the dynamics of inequality that define the legacy economy will persist in the emerging digital economy.

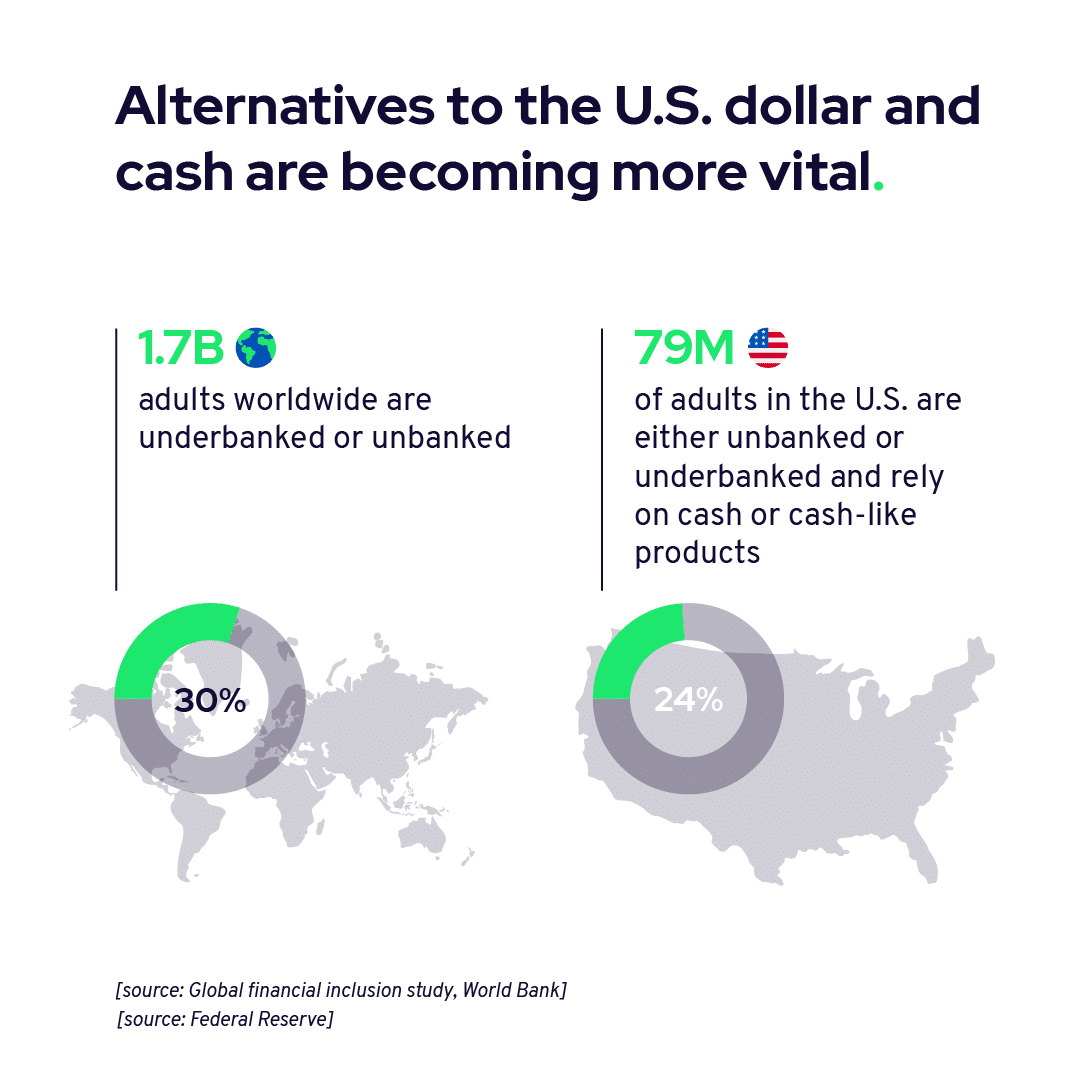

Transitioning to a digital economy

Cash still plays an important role in the world and the U.S. economy. Using cash is a necessity for lower income households, who utilize it more often and have a lack of banking and credit options. People operating in cash have fewer opportunities to access digital currencies, meaning they rely on U.S. dollars for transactions and savings. This means they are getting left out of one of the greatest wealth transfers of our lifetime.

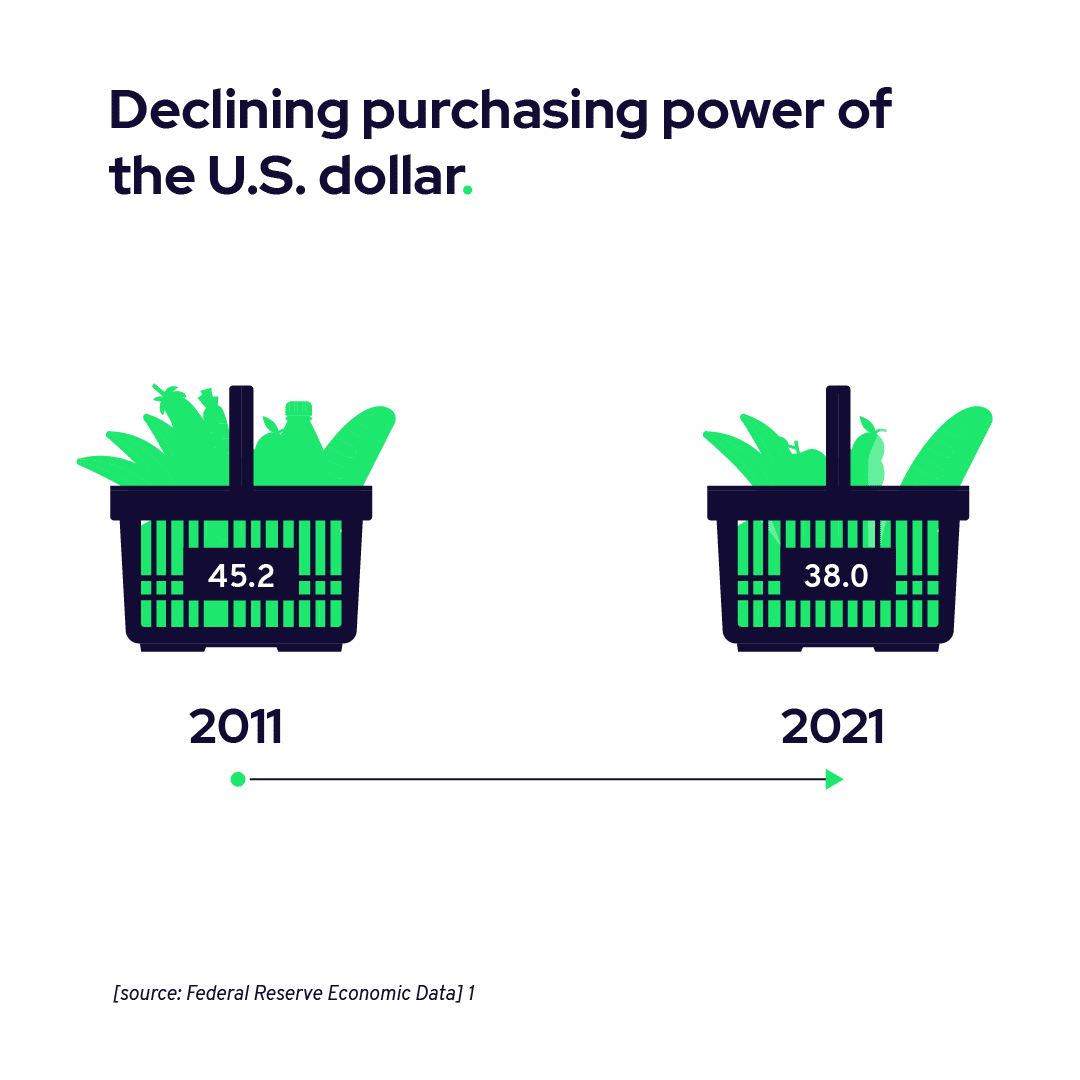

The strength of the U.S. dollar is waning. One easy way to measure this is to look at the consumer price index, or how much of the same basket of goods dollars can buy over time. The consumer price index is down to 38.0 from a score of 45.2 just ten years ago.

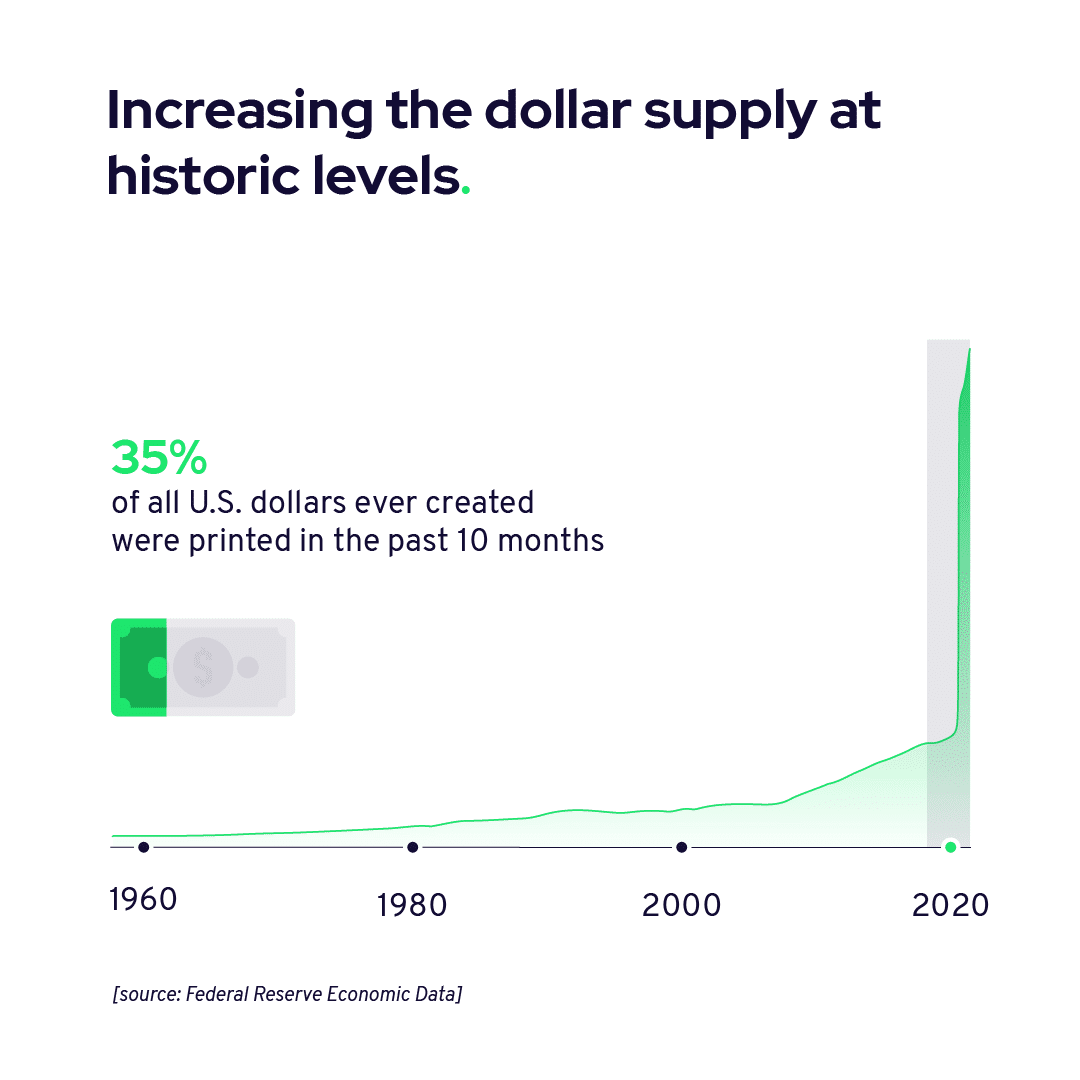

Since the financial crisis of 2008, the U.S. Federal Reserve has been printing money at record pace in order to stimulate economic growth. The long term impacts of this experimental monetary policy are still unknown.

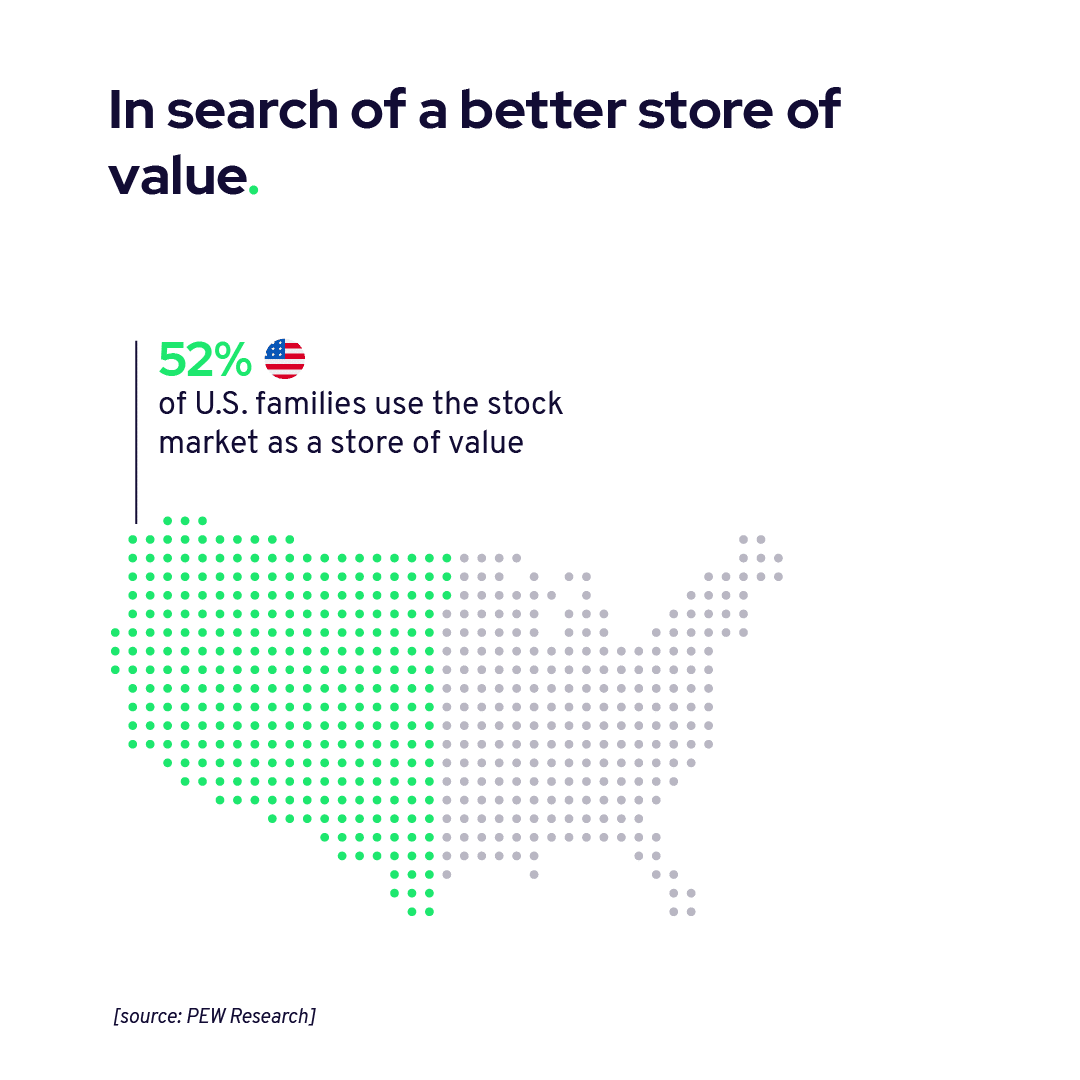

Traditionally, investment in stocks and bonds was a way to build wealth and save for retirement. But as the dollar-denominated economy sputters and interest rates drop closer to zero, the demand for alternative stores of value, like bitcoin, will increase.

Coinme and a new approach to access for all

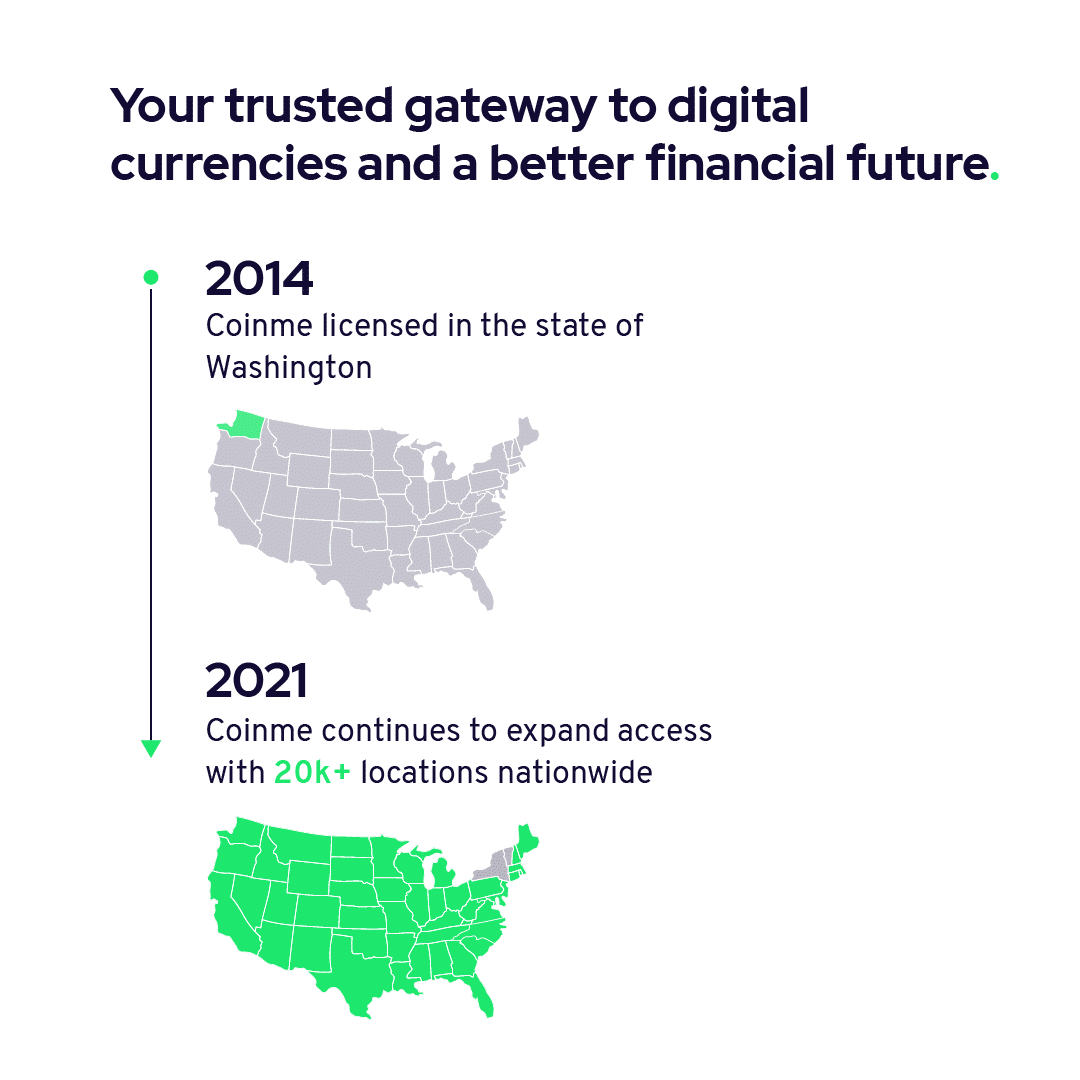

Coinme directly addresses the disconnect between the traditional dollar-backed economy and the need for alternative financial services enabled by bitcoin. Taking a network approach, Coinme works with partners like MoneyGram and Coinstar to cryptocurrency-enable existing financial infrastructure. Compliant to all financial regulations, and trusted by some of the world’s most recognized brands, Coinme is the leading cryptocurrency cash exchange in the world.

Sources

[source: Gemini]

https://www.gemini.com/state-of-us-crypto

[source: buybitcoinworldwide.com]

https://www.buybitcoinworldwide.com/how-many-bitcoin-users/

[source: bitinfocharts.com]

https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

[source: Global financial inclusion study, World Bank]

https://www.worldbank.org/en/news/press-release/2018/04/19/financial-inclusion-on-the-rise-but-gaps-remain-global-findex-database-shows

[source: Federal Reserve]

https://www.federalreserve.gov/publications/2020-economic-well-being-of-us-households-in-2019-banking-and-credit.htm

[source: Federal Reserve Economic Data 1]

https://fred.stlouisfed.org/series/CUUR0000SA0R#0

[source: Federal Reserve Economic Data 2]

https://fred.stlouisfed.org/series/M1SL

[source: PEW Research]

https://www.pewresearch.org/fact-tank/2020/03/25/more-than-half-of-u-s-households-have-some-investment-in-the-stock-market/