Overview

In the U.S., the mainstream views crypto and digital ledger technologies as speculative assets. It’s actually something that has long-lasting transformational potential. Developments like smart contracts and Decentralized Autonomous Organizations (DAOs) can drastically improve existing systems.

Cryptocurrencies have the potential to enable social and economic growth throughout the world. But so far, most of the societal benefits of cryptocurrencies and digital ledger technology are overshadowed by the hype about the wild price fluctuations.

Price is important. And overall, market liquidity and capitalization are attractive for adoption and for getting talented builders hooked on the ever-evolving ecosystem of digital assets.

But there is also a crypto version of the paradox of success — the more crypto prices increase, the more attention is paid to price alone. As a result, the gravitational pull is so strong that it detracts from the technology’s overall utility and potential.

In the U.S., crypto and digital ledger technologies are viewed by the mainstream more like a get-rich-quick scheme and less like a new form of the autonomous, peer-to-peer, distributed networking platform. And that comes down to hype. It’s easier to talk about crypto as a flash in the pan than to talk about the underlying tech as something that has long-lasting transformational potential.

It makes sense that the usefulness of crypto gets lost in the daily march of market winners and losers. Expecting people to get excited about a new application layer is unrealistic and unfair. We can appreciate the ease and utility of the technology without understanding its underpinnings.

And someday, crypto as an application layer — like the internet or instantaneous credit card transitions — will be running along in the background of our lives — and we’ll be past the market craze and the rollercoaster narratives.

So for now, let’s put prices and valuations aside. Instead, we’ll look at a few ways that cryptocurrencies and digital ledger technology (aka blockchain) represent a fundamental shift in how we coordinate and organize at a societal level.

Digital utility

Right now, the internet’s most used services — everything from retail and entertainment to social media and email — are controlled by just a handful of companies. The creation of internet monopolies has many implications, including a lack of meaningful options for consumers to explore.

This means that we all inevitably click “agree” on the terms of service page and end up exchanging our data (things like search behavior and preferences, who we communicate with, and even location info) to use a product or service with few alternatives.

One of the many innovations made possible by cryptocurrencies and digital ledgers is the idea of a smart contract, a code-based agreement that lives on the internet. Here are a few exciting developments:

- Tokens as incentives: Smart contracts work in companion with token-based systems which means that user activity can be monetized and incentivized outside the ad/attention-based model that dominates the internet today.

- Privacy: An encrypted infrastructure layer enables users only to reveal certain kinds of information and still maintain a private key, which will ultimately have ramifications for the concept of digital property rights or digital ownership.

- Network scale: DAO’s can leverage networks and data to make and enforce decisions that could eventually automate — or at least make more efficient — much of the work that is handled by massive bureaucracies.

- Interoperable: The best smart contract services will be interoperable with multiple blockchains, which means that users can decide where and how they share personal details and data and what kinds of token systems they support.

Today new companies are using smart contracts to build everything from better publishing, media, and video platforms to new ways of storing and sharing files (like an Uber for data).

Over time, as smart contract functionality becomes both more sophisticated and more user-friendly, smart contract-based systems will start to replace siloed and centralized internet services.

Inevitably, having alternatives will lead to competition and competition will mean that new networks and token-based economies will have to differentiate as they try to win market share.

This will lead to products that enhance user control, privacy, cost-effectiveness and data ownership. Because who will want to use a tech stack only to be served spookily targeted ads when they could instead be compensated for the amount of data and information they contribute to the internet?

Play this scenario out and it ends with an internet that resembles more of a customizable suite of services with fully tunable settings and preferences instead of the big box “one size fits all” version that exists today.

Smart money

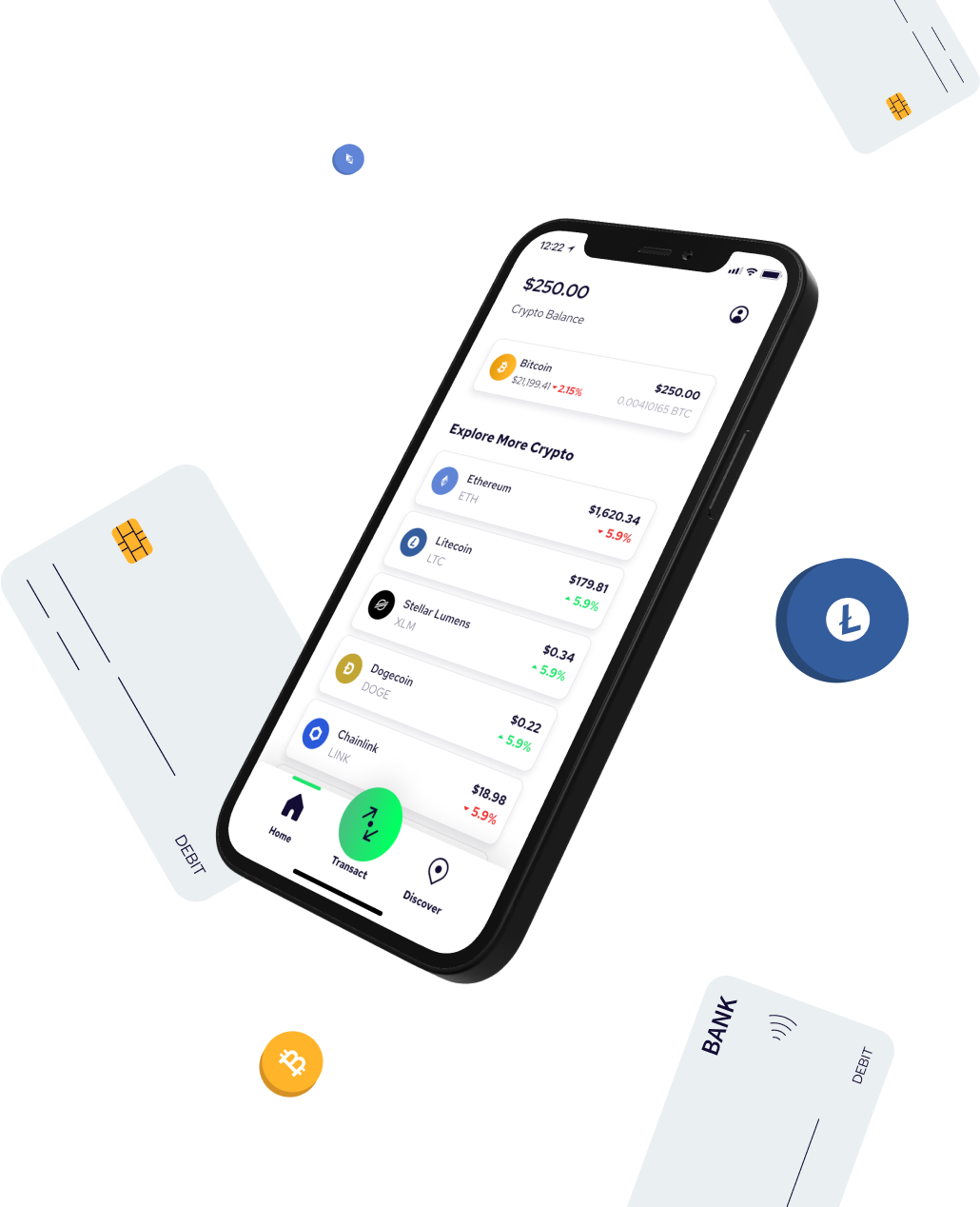

Being able to access the internet via a smartphone changed everything from getting driving directions to finding a date.

The ability to always be connected — to access personal data via the cloud — enabled it to leverage the internet in new ways and create new user experiences.

Crypto and digital assets represent a similar leap forward for the internet — they are like smart money for the digital age.

Instead of relying on specific platforms (like a credit card or an online bank account, for example), people will be able to access money in new ways via secure crypto wallets. Imagine if you could send money from one device to another without the need for any kind of bridge technology like a centralized payment processor with an off-switch.

Eventually, it won’t even matter what kind of crypto you hold; you’ll just be able to send the asset of your preference from a wallet of your choice, and the receiver will receive it in the asset they want, all thanks to code-based money.

This ease of use will make it simpler to manage everything from peer-to-peer cashless transactions to micropayments. In addition, secure and frictionless money could inspire new infrastructures like neighborhood-scale microgrids or integrated carbon offsets for everyday purchases.

Smart money also addresses current needs, like cross-border payments and remittances — both of which are notoriously slow and expensive, mainly due to the number of systems that traditional money has to pass through from point A to point B. With crypto, you just need a sending wallet and a receiving wallet to wait a few minutes for on-chain settlement.

A new dimension

The standard accepted definition of money is a fungible medium of exchange and a unit of account.

As we understand it now, money works fine in our physical world, but it starts to break down and create bottlenecks in the digital world.

Innovations, like the construction of the metaverse, immersive world-building games, or one-of-a-kind digital art, are all emerging and thriving because of digital ledger technology and cryptocurrencies.

Someday in the distant future, people will use digital asset wallets to conduct business in virtual worlds — and use the same wallet and currencies to conduct business in the physical world.

This means that digital assets will help create an entirely new way of making a living, creating, and communicating on the internet. And they will be the go-between the digital/virtual and the real-life/physical worlds.

The bottom line

Newer forms of smart money, like crypto and digital assets, will eventually become companion assets to traditional financial assets and services.

It’s no accident that crypto and digital assets are starting to gain mainstream attention and adoption right now. The simplest reason? The internet is incomplete without some native money system, which is precisely the void that crypto is filling.

Buy and Sell Crypto Instantly, Anywhere!

Get Started

Labs is acquiring Coinme to power the Open Money Stack.

Labs is acquiring Coinme to power the Open Money Stack.