eWallets Adopting Crypto

eWallets are gaining significant adoption worldwide. They are becoming the preferred payment method for consumers. eWallets are software allowing for various payment methods through a smartphone or computer.

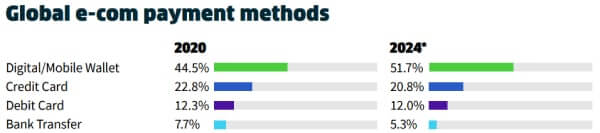

eWallet adoption will snowball in the coming years. According to WorldPay, digital wallet adoption for eCommerce will increase from 44% in 2020 to 51% in 2024. Digital wallets will take market share from cards and bank transfers.

Digital wallets will continue to grow as they add innovative products.

Adoption of eWallets

The pandemic accelerated the adoption of digital wallets, especially for mobile payments.

A survey by finder.com found that 150 million Americans have used a digital wallet for payments in 2021. This adoption had increased 3x from two years ago when only 39.8 million Americans said they had used a digital wallet.

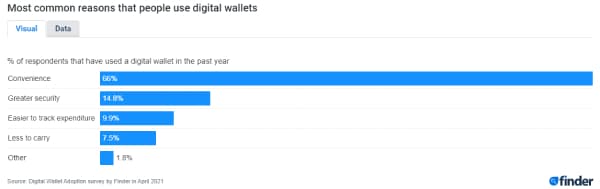

Americans use digital wallets because they believe they are more convenient and secure than traditional payment methods.

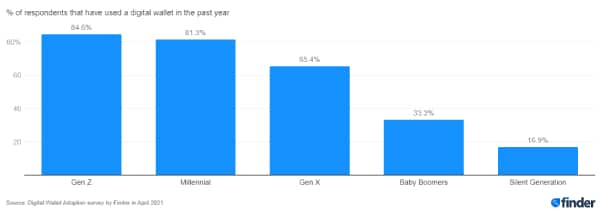

Younger generations tend to use digital wallets more than older generations. Over 80% of Gen Z and Millennials have used a digital wallet in the past year compared to less than 34% for Baby Boomers and the Silent Generation

As we continue to see innovation in eWallets, there will be less need to use traditional payment methods such as cash or cards.

eWallets are adding crypto

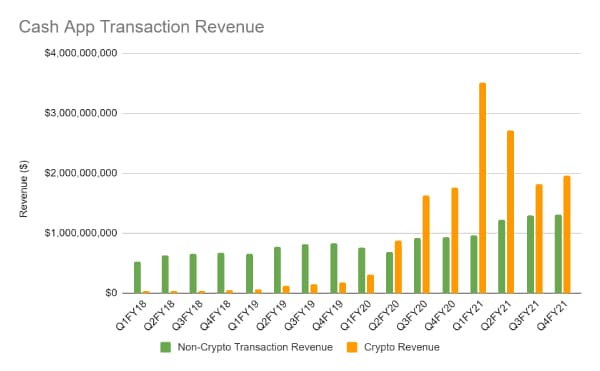

eWallets are integrating crypto into their platforms globally. The first digital wallet to add crypto was Cash App in 2018. Since Cash App added crypto to their wallet, they have seen incredible revenue growth. Cash App crypto revenue increased from $34 million in Q1 2018 to $3.5 billion in Q1 2021, a 102x increase in crypto revenue over three years. Crypto revenue even surpassed all other transaction revenue in Q2 2020.

Cash App isn’t the only digital wallet that had success by adding cryptocurrency. In October 2020, PayPal allowed its users to buy, hold, and sell crypto on their platform.

In response, PayPal saw incredible platform engagement immediately after launch. PayPal reported a 3x higher usage frequency for bitcoin traders than non-bitcoin traders. Shortly after adding crypto to PayPal, the company added crypto to Venmo.

Adding cryptocurrency has been a massive success for these digital wallets. It has increased revenue and platform engagement for both Cash App and PayPal. Adding crypto to digital wallets will benefit businesses.

Digital wallets must add crypto

Digital wallets need to add crypto to stay relevant against their competitors. Younger generations have adopted digital wallets and cryptocurrencies faster than other demographics. Users demand to have crypto in their digital wallets.

There are benefits to adding crypto to eWallets, such as:

- Increased user engagement through crypto trading

- Another payment option for users who want to pay in crypto

- Creation of an additional revenue stream through crypto transaction fees

Using Coinme’s crypto APIs, your digital wallet can allow your customers to buy, sell, and hold seven cryptocurrencies directly on your platform. There are no hidden integration fees, just crypto for your customers. You can find more details for partnering with us on our website here.

It’s only a matter of time before every digital wallet will have a crypto integration. When the biggest eWallets in the world add crypto, it will become clear this technology will only continue to grow.

Labs is acquiring Coinme to power the Open Money Stack.

Labs is acquiring Coinme to power the Open Money Stack.